And I know that when you get to a place where you have peaceful, calm waters, regarding your finances, it’s going to take so much stress off. I have felt the relief and I want you to feel that as well. It’s that some people love numbers and plugging things in.

- This self-employed edition of QuickBooks includes the basics for tracking taxes, keeping track of customers and bills, and organizing income and expenses.

- And finally, when a gallery represents an artist, it’s usually an exclusive arrangement within a certain territory, such as an entire state.

- What kind of products can you create that will be profitable?

- However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

He uses an accordion file for the receipts and statements. Keeping track of your expenses will also be a breeze with the expense tracker. The best thing is that the software will help you compare these values by displaying them on a single graph.

QuickBooks Self-Employed: accounting with built-in tax support

I want to be very honest, that we’ve had some ups and downs for sure, related to money. And I think part of that caused even more of that dread is I used to hate the numbers and the accounting. I think part of it is because it just seemed so stressful for me. It wasn’t as hard as I thought, but it still wasn’t enjoyable. We’re using an online system called Xero, it’s xero.com. And it is probably a little bit more expensive and robust than what most of you will need.

Industry-specific difficulties for freelancers include the qualifying business income deduction for certain service businesses, responsible programs for cost reimbursements, and reasonable wage estimates for S-corporation owners. Allow us to use our wealth of expertise and experience to ease the burden of business tax preparation off your shoulders. Now, if you think turning your passion into a profession is as easy as pie, then you are incorrect. Along with your art, you also have to learn the ‘art of accounting.’ You can take guidance from accountants for artists, but it does not eliminate the importance of knowing accounting basics yourself.

Pentacle remains dedicated to continuing to provide a high level of support to artists during these extraordinary circumstances. Alongside many other key and respected organizations in the field, we have begun accumulating and curating resources for artists and organizations experiencing income loss and other troubles as a result Accounting for artists of the COVID-19 crisis. Another revenue source is home delivery and hanging services. They bring artwork to your home and hang it for you, and might even arrange to have lighting installed for it. And as another source, galleries sometimes rent out their space for private receptions, so there can be some rental revenue.

Best Accounting and Bookkeeping Software for A Hair Salon in 2023

You will also want to ask questions concerning other tax strategies that are available to you as well as state requirements for filing sales tax, due dates and other compliance issues. As a final note, if the IRS ever audits you, your proof for business deductions, including your proof that you are conducting a business and not a hobby, will be in your record keeping. Some artists may experience difficulty keeping track of their finances and estimating how much income they can realistically expect from their work. Wave is a simple, elegant, and intuitive way for you to keep track of your finances. Wave is designed with the needs of artists in mind, with features like calendar views that allow you to see where your income came from to predict future earnings.

If you are anything like me, it is hard enough for me to record dates and appointments in my date book! I don’t want to clutter it further with business information. You can computerize your record keeping without the purchase of an expensive accounting program.

Financial Service Center

Wave offers a pay-per-use payment service that lets your clients pay right from their invoice. I know record keeping and taxes can be a bit overwhelming and not the rewarding part of our passion. Hopefully with this knowledge you are not as “overwhelmed”. If you decide to shop for a tax preparer make sure that the person has experience in the taxation of artists.

The Back Room: It’s Gogo Time – artnet News

The Back Room: It’s Gogo Time.

Posted: Fri, 28 Jul 2023 07:00:00 GMT [source]

We’re able to solve some financial problems for artists, but we know that there are others that are beyond our scope. We often get asked if we can help artists manage their finances more directly. We get asked if we can help with payroll, budgeting, bookkeeping, and overall accounting support.

Tracking Expenses

They can also take advantage of these features to pull some data into their accounting software for artists and make better-informed decisions about what they need from you to do their job properly. Many freelancers and artists have income from other sources outside of their freelance activity. This creates complex planning issues that can be difficult to manage. Casey Moss Tax can prepare tax projections throughout the year to make sure you are never surprised come tax time. We can also guide you through strategies to reduce your tax liability before it’s too late to take action.

When she is able to leave, she has enough cash on hand to put gas in her car and get to the theater before the opening curtain call. The General Ledger is your link to updates on people, policies, and other information related to financial transactions at the University. It’s important to look into which system is best for you, considering all the different advantages and disadvantages. At first, I was skeptical about switching from QuickBooks Pro to FreshBooks because it was web-based, but it now feels like the perfect fit for my small studio. AccountingTools is an IRS Approved Continuing Education Provider.

User account menu

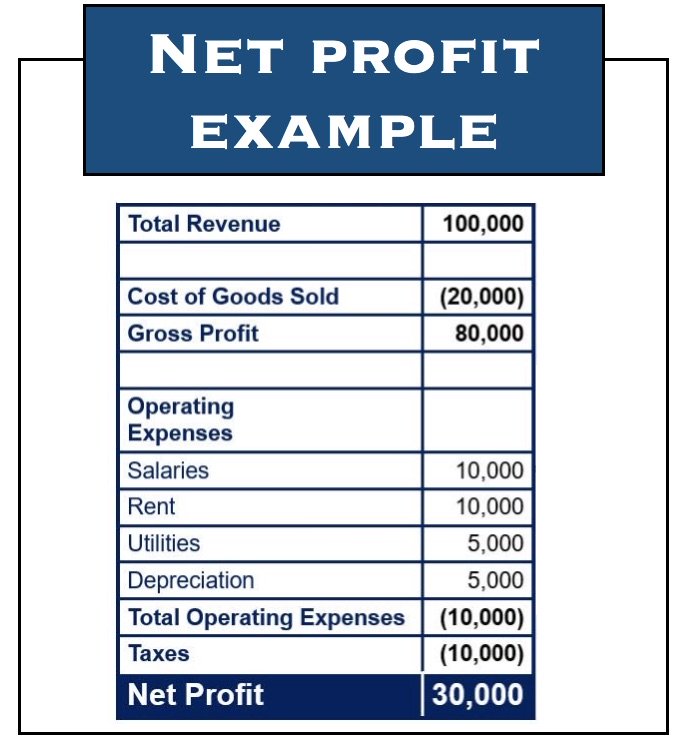

I was like, Oh, yeah, there’s more money going into this product than I was really thinking about. So you really need to think about all of your expenses. So, if you have an Etsy shop, it is all of the money that’s coming in, whether it’s the sale that you made, the shipping that they paid, all of that would be considered revenue. In the process, we realized we needed to hire someone to help us. It wasn’t as expensive as I thought to hire an accountant.

- With the Sage Accounting plan, you may invite multiple users to your account and give them one of five user roles.

- Which is why most of them only have a couple of people on staff.

- Manage your financial records, send invoices, monitor inventory, and even process payroll with this all-in-one package.

- Like Agro Accounting and Hell Yeah, Bookkeeping, Brass Taxes services are specifically designed for creatives and freelancers.

There are plenty of creative ways to make money as a professional artist by using your artistic skills. Moreover, this cloud-based software is built for all in one. Artists can manage their art, host marketing campaigns, and create web services on a single platform. This allows them to monitor collections, retain data, and expand the artwork’s operation. With Hiveage, artists and musicians can easily migrate their invoicing to a cloud database, saving a lot of time for paperwork and allowing them to focus on growing the operation rather than keeping up with the documentation.

Unfortunately we can’t help you out directly here, but we can point you in the direction of some folks who can. In our bookkeeping software, Xero, our accountants have set it up so that we see the income first. And then we take away or subtract the cost of goods sold. The Cost of Goods would be like when we sell workbooks, the Brush Lettering workbooks, it would be the cost of buying the workbooks for our inventory.

Given the cost of artwork, a gallery may end up having to charge sales taxes in the hundreds or thousands of dollars on a single sale. Which means that it needs to have a sales tax license, track sales taxes, and remit them to whichever government is collecting it. Depending on the artist, they can sell every single piece that’s displayed in these shows, and sometimes it’s even sold in advance. That’s because most artists have a following of collectors, who want access to their artwork before anyone else can buy it. So that’s what happens – the collectors buy the artwork in advance, and then its displayed at the show, with a little red dot in the corner, which signifies that it’s already been sold. Sunrise provides professional accounting services to upgrade their free application since most business owners do not want to get complicated with bookkeeping.

Even if an artist doesn’t need to file quarterly, looking over and updating tax information every three months will make completing an annual tax return simpler. A small team of eight launched Wave Accounting in 2010. Today, it’s used by more than 2 million entrepreneurs. Wave’s free web-based money management tools offer dozens of invoicing and accounting features. Plus, you can download iOS and Android apps to handle payments or view account balances from anywhere.

5 Low-Cost or Free Accounting Tools for Artists – CO— by the U.S. Chamber of Commerce

5 Low-Cost or Free Accounting Tools for Artists.

Posted: Fri, 28 Apr 2023 07:00:00 GMT [source]

For freelancers that have made the leap into LLCs or S-corporations, Casey Moss Tax has you covered. Let us utilize our wealth of knowledge and experience in this industry to take business tax preparation off your plate. Most of them make very little money, usually less than $200,000 of revenue per year. Half of that goes to the artists, so they don’t have much money left over to pay for the rent and utilities and employee pay.

The system easily audits your spending and conveniently shares a workspace with clients. Weekly bookkeeping tasks focus on keeping necessary supplies and labor available and efficiently billing for completed projects to maintain a healthy cash flow. So it’s really essential that you know your basic numbers. I just want to encourage you today, if you’re not making a profit, you can change that.